Grow Your Business with Digital Marketing You Can Trust

Grow with a clear plan, better online visibility, and more time to run your business without worrying about where your next customer is coming from and if your competition is doing better than you are.

Overwhelmed by learning AI, and struggling to find time for marketing?

Problem solved.

Running a business is already a juggling act, and digital marketing shouldn’t be another ball to drop. With a local, AI digitally-driven marketing agency on your side, the busywork’s handled so you can get back to what matters most.

What’s an AI Digital Marketing Agency?

An AI digital marketing agency uses technology to do what’s important, this gives us faster turn around times, the ability to check data fast, create Ads that connect and follow the latest trends.

That gives our team more time to do the human stuff, like planning strategies, creating content people love, and helping your business grow.

Lisa Beattie

General Manager – Lakeshore Manor

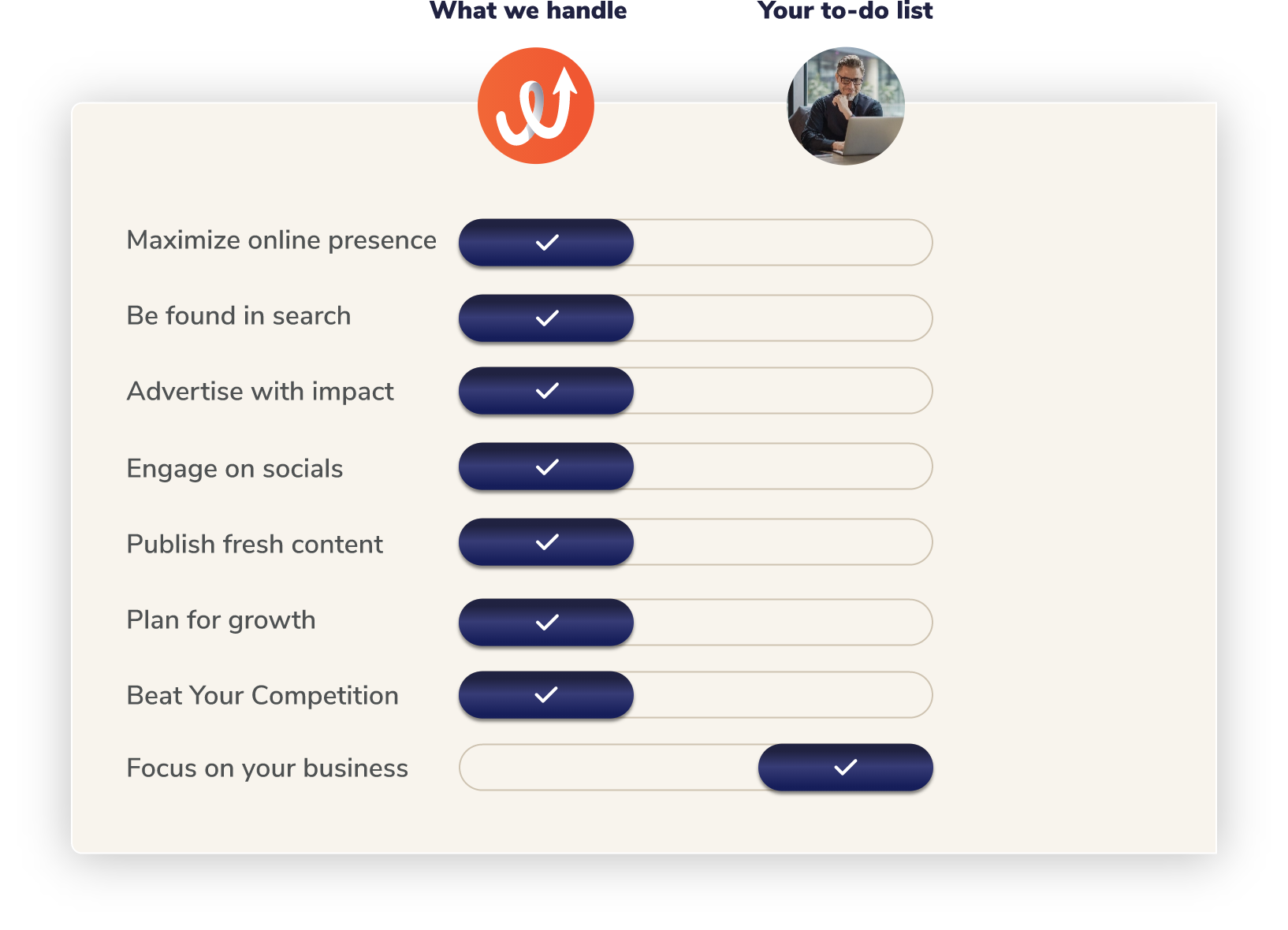

When Marketing Steals Your Time, We Give it Back.

Running a business stretches you thin, and running your own marketing only adds to the pressure.

We take care of your marketing, leveraging AI and bring the creative spark with our team, so you can finally catch your breath and see results from smart digital marketing without burning out.

AI Isn’t a Shortcut When You Have No Time.

Every week there’s a shiny new AI tool that swears it will save you hours. But who has time to stay on top of it all?

By the time you figure one out, another shows up—and suddenly marketing feels like a full-time job you never signed up for.

Leveraging AI well takes daily practice, and most small businesses just don’t have the time or energy for that.

Your Marketing,

Made Simple

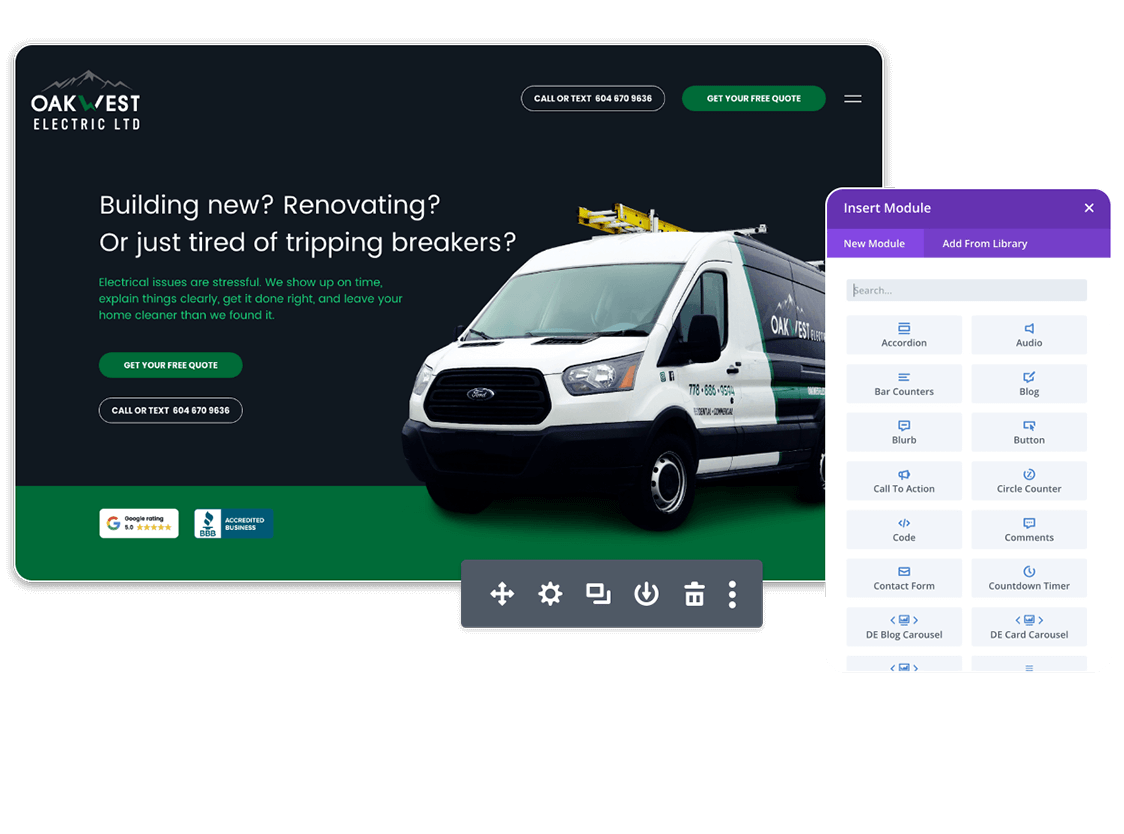

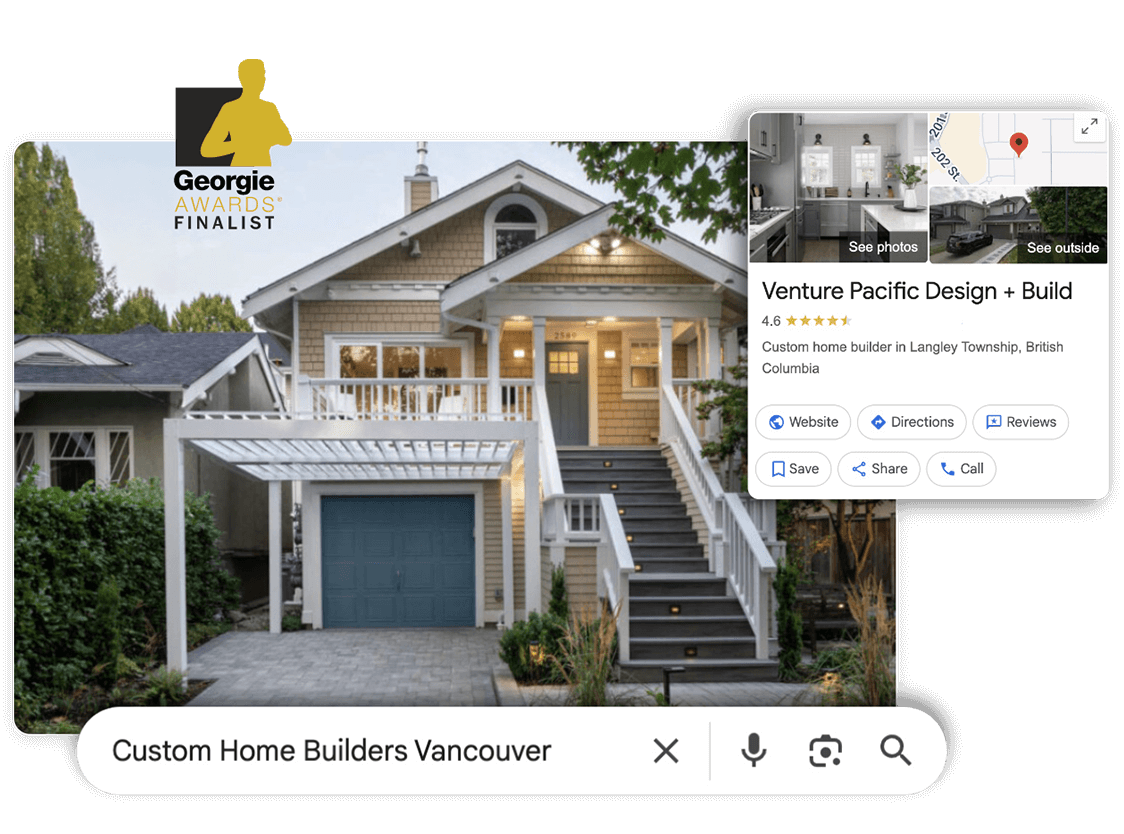

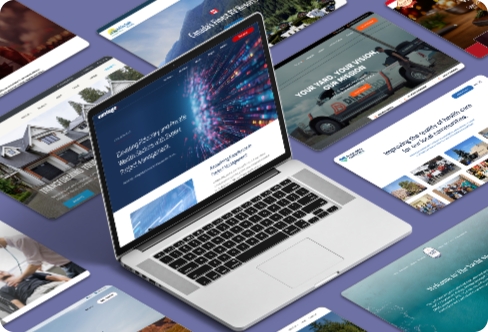

Website Development

A site that looks great, gives your customers the information they need, and makes your business easy to find wherever it’s searched.

SEO, GEO & SGE

Get found with smart search strategies that bring real results.

Digital Ads Management

Ads that actually work – bringing clicks, calls, and customers.

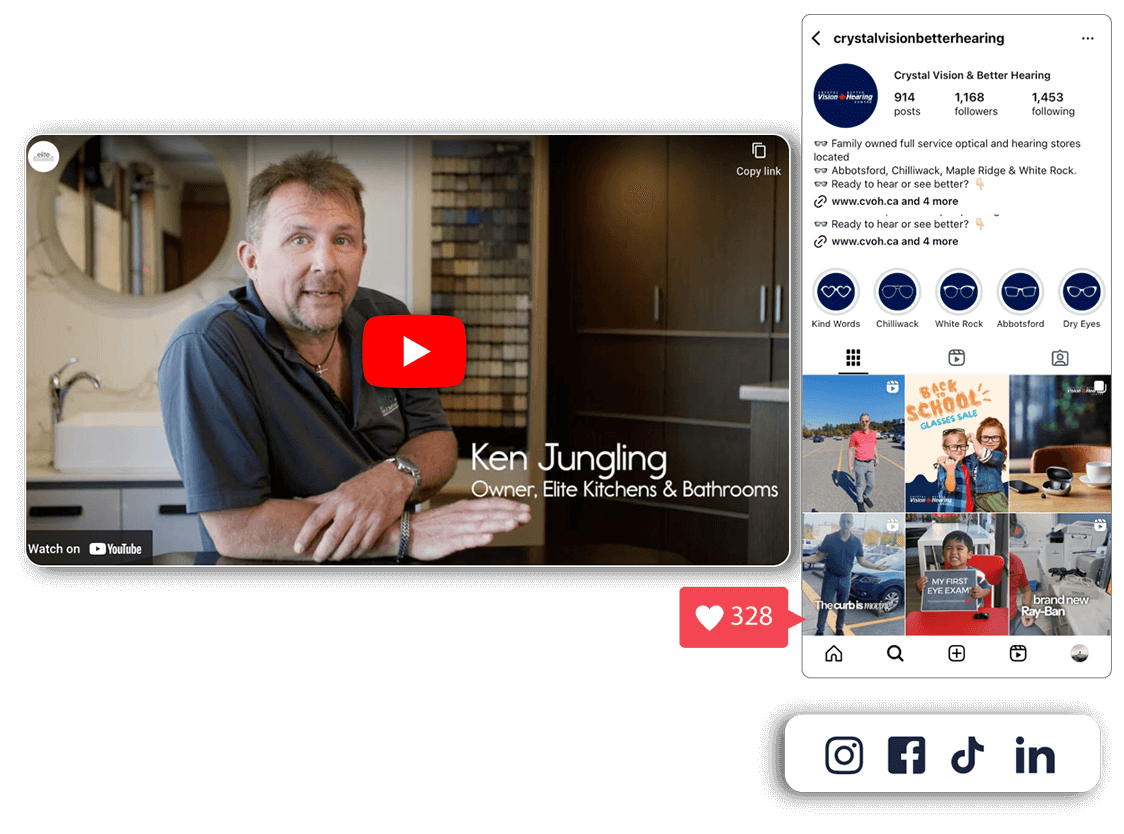

Social Media Management

Consistent posting, engagement, and content your audience will love.

Content Marketing

Fresh blogs and newsletters that connect with your audience and build trust.

Digital Marketing & Strategy - Your own personal Coach

Step-by-step advice that makes that makes running your business easier.

The WMSH Game Plan: 3 Simple Steps

Let’s Talk

We start with a detailed Zoom call to learn all about you and your business, and what’s giving you headaches and frustrations.

Get Your Game Plan

We look at what’s working, fix what’s not, and give you a clear plan that blends AI smarts with our creative spark.

Put It Into Action

We run the plan, track results, keep you posted, and keep things simple – so you can stay focused on your business.

The WMSH Pledge:

Marketing You Can Trust with A Team That Has Your Back

When you work with us, here’s what you can always expect:

No BS:

No buzzwords, no confusion; just smart strategy and real results.

Honest Results:

We track, measure, and show you what’s actually working.

Human Touch:

AI helps with the busywork, but our team brings the creativity, empathy, and ideas.

Your Business First:

Every decision we make is to help you grow, not to pad our profits.

Small Businesses

supported worldwide

Tailored Strategies

created across different industries

%

Client-Focused Service

that puts you and your business first

Real Businesses, Real Results

Let’s Make Marketing Easy

Tired of doing it all yourself? With WMSH, you get a clear plan, a team you can trust, and more time back in your day

Meet Your Team

Meet Your Team